What is RDA Index

Motivation

250 million people and thousands of institutions want to know the intrinsic value of cryptoassets beyond the speculative, exaggeration and hype.

The points system of RDA Index help crypto users, investors and analysts to quantify the intrinsic value of cryptoassets and to better manage the risks involved in dealing with the asset class.

Traditional Assets vs Cryptoassets

Because we conduct most of our business with people who do not know us personally, traditionally there has been a need for a central authority to guarantee the value of the currency we use in financial transactions.

Although centralised monetary systems provide an environment where everyone believes in the same currency and standards of value, proponents of cryptoassets claim that it has concentrated too much decision-making power in the hands of a single institution that may be vulnerable to mismanagement. Along with the inherent risk of mismanagement, crypto enthusiasts argue that the intermediation of every digital transaction by a central authority and other affiliate banks is a source of technology and cost inefficiencies to the overall financial system.

The 2008 financial crisis was a clear example of how these inefficiencies can damage the health of the monetary system with the cost of rescuing the system totalling some £500 billion (approximately $850 billion) alone in the UK. The government also invested in some banks to keep them alive with the investment sold back to the market at an overall profit to the taxpayer.

Bitcoin, the first cryptoasset was invented in the aftermath of the 2008 financial crisis, and the crisis was a clear incentive for its creation. Fast forward to January 2021, over £800 billion pounds had migrated from traditional financial markets into cryptoassets.

The Intrinsic Value of Cryptoasset

Cryptoassets enable peer-to-peer transactions. A peer-to-peer transaction simply means the transaction is always between two parties (peers) without any intermediary. In a cryptoasset payment network, value goes from one person (peer A) to another person (peer B) without the need for a central authority or intermediary (e.g., bank) to regulate the value of the asset being used or facilitate the transaction. The network is decentralised. This decentralisation of cryptoasset networks is achieved through a network of computers all over the world who have no affiliation with one another. This network is often referred to as the blockchain. Most of today's blockchain payment transaction run without a person, company, bank, or government to mediate or control their settlement. Participating computers in the network are owned by a community of individual or institutions who are rewarded in cryptoassets for their participation.

There are two types of blockchain networks, permissioned and permissionless. Permissioned network is restricted by policy to a specific group of participants, while permissionless networks such as Bitcoin, Litecoin, Ethereum, etc are open to anyone with access to the internet thus making them borderless and inclusive. Due to the advanced coding involved in storing and transmitting cryptoassets, they are generally considered to be safe and secure so long as they reside on the blockchain.

Despite their intrinsic nature to enable borderless-permissionless-decentralised peer-to-peer transactions, behaviour consistent with speculative trading accounts for the majority of cryptoasset use cases. In other words, most people buy and keep cryptos not because of their promise to deliver a more inclusive and censorship resistant financial system. Rather, people mostly buy, hold and eventually sell cryptoassets for financial profit or in most cases a loss. The FCA cryptoasset consumer research 2020 concluded that 47% of people considered buying cryptoassets as a gamble that could make or lose money, 25% sees it as part of their wider investment portfolio, 22% don't want to miss out on a money making opportunity, 17% classifies it as part of their long term savings plan (e.g. pension), and 7% invest in it because they don't trust the current financial system. Majority of people buy them on the expectation that the asset will increase in value over time due to more people buying speculatively. This has resulted in a volatile asset class that create risks for users and investors at all levels of the pyramid.

RDA Index Approach

Most of the cryptoassets hold similar promises of peer-to-peer decentralised financial system. In principle, they have the same fundamental attributes. They however differ in practical terms as to how they fulfil their ambition to deliver a libertarian financial system to investors and users.

Before we explore the RDA Index approach for evaluation and ranking of cryptoassets, we clarify a few assumptions:

lIntrinsic value can be measured on any scale. RDA Index measures intrinsic value on a scale of 0 to n where 0 indicates no intrinsic value and n is the highest intrinsic value.

Intrinsic value is not synonymous to price although price value may be derived from intrinsic value based on an appropriate conversion model.

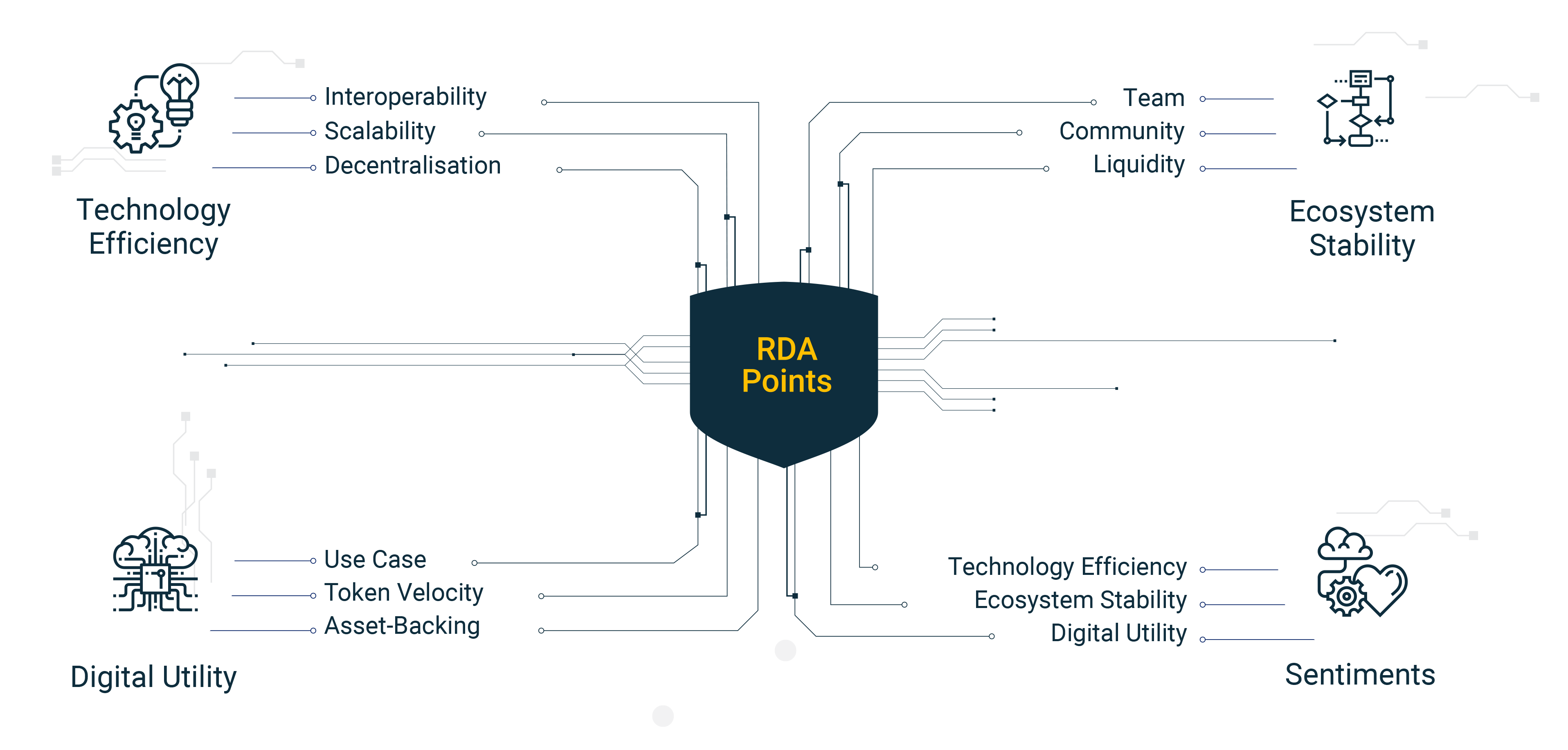

The intrinsic value of any cryptoasset can be determined based on its underlying qualities. We refer to these qualities as Real Digital Asset (RDA) Attributes.

Hence, we define RDA Attributes as the core drivers of the intrinsic value of cryptoassets,

Real Digital Asset Attributes

"I

think the internet is going to be one of the major forces for reducing the role

of government. The one thing that’s missing but that will soon be developed, is

a reliable e-cash, a method whereby on the Internet you can transfer funds from

A to B without A knowing B or B knowing A.”

Milton Friedman, 1991

We take Friedman's conjecture for granted that

users of cryptoassets value the ability to engage in trust-less, decentralised,

censorship resistant peer-to-peer financial transactions. From these

value drivers we derive several other qualities, demand-side and supply-side,

that a cryptoasset must have to be of value to users. We aggregate these

qualities into to four distinct groups which we refer to as Real Digital Asset

(RDA) Attribute Groups. Detailed analysis of the RDA Attributes is

outside the scope of this article. We present a broad view of the attributes as

follows:

Business Ecosystem Stability (E)

The Business Ecosystem Stability component represents resilience and the

capability to maintain a stable state of socio-economic equilibrium that keeps

the cryptoasset alive and valuable. This group of attributes reflects the value

brought to the token by the strength of the team, community, investors and the

influence of competitors and regulators.

Digital Utility (U)

Much of the speculation around the value of digital assets stems from their

promise as investment vehicles, and this area is subject to intense regulatory

scrutiny from securities agencies. However, for other tokens, at least a

proportion of their value is intrinsic to their actual use case within a

payment or software application ecosystem. A pure utility token may still rise

in value if the ecosystem for which it is developed undergoes growth and demand

increases, however under this group of attributes we examine the extent to

which the token has inherent value due to its use cases both on-chain and

off-chain.

TTechnology Efficiency (T)

All cryptocurrencies may be regarded as innovative technologies, however with a

13 year history now to draw upon, different technologies may be regarded as

having distinguishable track records of effectiveness. As a range of different

consensus mechanisms and mainnets proliferate at this time, we compare a

diverse range of factors to yield evaluations of how efficient and secure the

specific technologies in use are.

Sentiments (S)

The Sentiments attributes seeks to measure the level of sentiments that

persists in favour of the asset's fundamentals i.e. ecosystem stability,

utility, and the underlying technology. In an era when hype has had far too

much influence on cryptoasset valuation and pricing, RDAi is keen to ensure

sentiment is viewed with the appropriate lenses as another important factor

alongside the preceding groups of core RDA attributes. The role of sentiment on

the intrinsic value of cryptoassets cannot be downplayed particularly in the

social endorsement of an asset's intrinsic worth.

To model the intrinsic value of a cryptoasset, A, we specify a

mapping (E, U, T, S) ---> r(A) that quantifies the intrinsic value

of the asset as a function of its attributes.

The Problem with Current Intrinsic Valuation Approaches

Since December 2011, many organisations include Wall Street have issued cryptoasset valuation guidelines. In doing so, comparisons are often made between the market capitalisation of cryptoassets and that of traditional assets. These sorts of comparisons are unreliable for many reasons: first and foremost, unlike Companys' market capitalisation value- the market capitalistion value of cryptoassets are not driven by industrial economic activities that asset creators are mandated to execute. Rather the factors that drive the value of cryptoassets are multi-faceted, cross-domain and highly fluid. This is not necessarily a weakness, it is often stated as strength of an asset class that is built on a censorship and regulatory free ecosystem.

Benefits of RDA Index

The RDA Index methodology for evaluation cryptoassets serves as a flexible and dynamic approach to determine the intrinsic value of cryptoassets. RDA Attributes-weighting is also a mechanism to arrive at objective prices of cryptoassets (through translation of their intrinsic value measure to FIAT value).

Crypto Market Fundamentals at Speed

Market IV Level provides a measure of how the overall cryptoasset market is faring over time.

The Market IV Level serves as a reference for the evolution of fundamental drivers of the cryptoasset industry. By definition, it is the higher frontier of intrinsic value of cryptoassets.

The IV Level calculation empowers users and market analysts with the confidence and trust required to engage effectively in a decentralised cryptoasset economy.

Asset Integrity and Systemic Risk

The RDA IV Rating establishes a 5-tier Intrinsic Value (IV) rating system for cryptoassets. RDA IV Ratings enable people and institutions to identify toxic assets, counter-party and investment risks. We rate and rank assets based on their underlying attributes and not based on hype.

True Price

The RDA Index data allows market participants, analysts and regulators to summarise market pricing of cryptoassets with respect to their underlying attributes. The fundamental price data promotes investment-type behaviour and reduces market volatility arising from excessive speculation.

Analysis and Commentary

The RDA Index Data Suite provides market commentators with a reliable fundamental analysis of the market without having to read thousands of technical documents.

Investment Portfolio Management

RDA Index Data Suite provides a powerful combination of ranking, rating and signals to enable better portfolio construction and risk management.

Business Payments

Determine which cryptocurrency to hold and spend/accept in day-to-day payment transactions.

Regulatory and Compliance Policies

Using RDA Index Data Suite, regulatory and compliance institutions can better formulate consumer protection policies that seeks to limit the circulation of toxic assets.